|

|

|

|

|

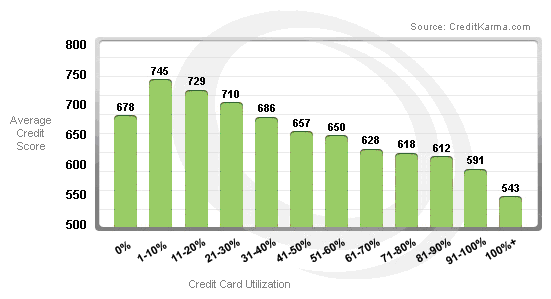

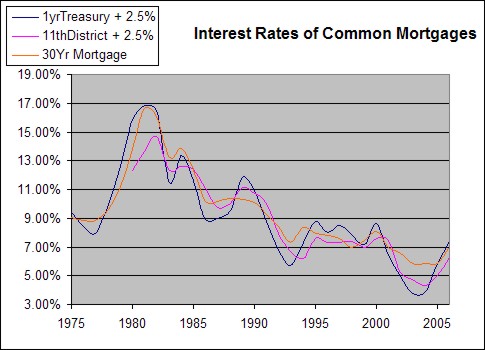

Home equity is the market value of a homeowners unencumbered interest in their real property—that is, the difference between the homes fair market value and the outstanding balance of all liens on the property. The rate is tied to the Prime and could change as much as at every billing date. A lender calls to talk about refinancing, and using the availability of extra cash home equity loan as bait, claims it's time the equity in your home started "working" for you. In Denmark, similar to the United States capital market, interest rates have fallen to 6 per cent per annum. Certain abusive or exploitative lenders target these borrowers, who unwittingly may be putting their home on the line. But this only applies if you itemize your deductions. May my monthly student loan payments are too high. Mortgage loans are generally structured as long-term loans, the periodic payments for which home equity loan are similar to an annuity and calculated according to the time value of money formulae. Many countries have a notion of standard or conforming mortgages that define a perceived acceptable level of risk, which may be formal or informal, and may be reinforced by laws, government intervention, or market practice. Unfortunately, if you agree to a loan that's based on the equity you have in your home, you may be putting your most valuable asset at risk. However, gross borrowing costs are substantially higher than the nominal interest rate and amounted for the last 30 years to 10.46 per cent. Therefore, the mortgage insurance acts as a hedge should the repossessing authority recover less than full and fair market value for any hard asset. The interest rate is low and the monthly payments fit nicely home equity loan into your budget, but you could use some extra money. Investment-backed mortgages are seen as higher risk as they are dependent on the investment making sufficient return to clear the debt. All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender's risk. The equity in your home may be able to help you finance major expenses. The mortgage origination and underwriting process involves checking credit scores, debt-to-income, downpayments, and assets. Chapter 7The interest is rolled up with the capital, increasing the debt each year. In some jurisdictions, mortgage loans are non-recourse loans. HELOCs and home equity loans can also be used as second mortgages at the time of purchase. Buydown mortgages allow the seller or lender to pay something similar to mortgage points to reduce interest rate and encourage buyers.[7] Homeowners can also take out equity loans in which they receive cash for a mortgage debt on their house. Mortgage payments, which are typically made monthly, contain a capital (repayment of the principal) and an interest element. You ask for a payoff statement to refinance with another lender and receive a statement that's inaccurate or incomplete. Automotive RecruitmentFeb homeowners offered more record low rates but beware fees traps mortgage. A contractor calls or knocks on your door and offers to install a new roof or remodel your kitchen at a price that sounds reasonable. Home buyers can avoid buying mortgage insurance (PMI) if they take out two loans instead of one, with no single loan exceeding 80 percent of the purchase price. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but because most mortgages occur as a condition for new loan money, the word mortgage has become the generic term for a loan secured by such real property. Islamic mortgages solve this problem by having the property change hands twice. In the event of repossession, banks, investors, etc. Auto Loan In Omaha During BankruptcyIf you take out a loan but don't have enough income to make the monthly payments, you are being set up. It is used commonly in loans with a loan-to-value ratio over 80%, and employed in the event of foreclosure and repossession. The Federal Trade Commission urges you to be aware of these loan practices to avoid losing your home. Frequently they are the second purchase mortgage for 10, 15, or 20 percent of the purchase price when buying a home. After you've made a few payments on the loan, the lender calls to offer you a bigger loan for, say, a vacation. Many other jurisdictions have similar transaction taxes on change of ownership which may be levied. Few individuals have enough savings or liquid funds to enable them to purchase property outright. And what's worse, you are now paying interest on those extra fees charged in each refinancing. Some plans may call for payment in full of any outstanding balance at the end of the period. Investors typically look to purchase properties that will grow in value, causing the equity in the property to increase, thus providing a return on their investment when the property is sold. You tell him you're interested, but can't afford it. Craigslist Rent To Own HouseHome equity management refers to the process of using equity extraction via loans—at favorable, and often tax-favored, interest rates—to invest otherwise illiquid equity in a target that offers higher returns. May property of caterpillar decals wells fargo repo list construction equipment on repossessed construction. Participation mortgages allow multiple investors to share in a loan. The Loan to Value and your credit score determine the interest rate of a home equity loan or line. Upon making a mortgage loan for the purchase of a property, lenders usually require that the borrower make a downpayment; that is, contribute a portion of the cost of the property. In other jurisdictions, the borrower remains responsible for any remaining debt. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed and on moving house further borrowing is arranged on a capital and interest (repayment) basis. These arrangements are variously called reverse mortgages, lifetime mortgages or home equity loan equity release mortgages (referring to home equity), depending on the country. This policy is typically paid for by the borrower as a component to final nominal (note) rate, or in one lump sum up front, or as a separate and itemized component of monthly mortgage payment. With a home equity loan also known as a second mortgage, term loan or equity. At some point after the contractor begins, you are asked to sign a lot of papers. When interest rates are high relative to the rate on an existing seller's loan, the buyer can consider assuming the seller's mortgage.[5] A wraparound mortgage is a form of seller financing that can make it easier for a seller to sell a property. This is typically generated by an amortization calculator using the following formula. At the end of the loan term, the principal-that is, the entire amount that you borrowed-is due in one lump sum called a balloon payment.

Abusive lending practices range from equity stripping and loan flipping to hiding loan terms and packing a loan with extra charges. Any amounts received from the sale (net of costs) are applied to the original debt. In most jurisdictions, a lender may foreclose the mortgaged property if certain conditions - principally, non-payment of the mortgage loan - occur. A lender tells you that you could get a loan, even though you know your income is just not enough to keep up with the monthly payments. In some countries, such as the United States, fixed rate mortgages are the norm, but floating rate mortgages are relatively common. Myfax provides a solid online faxing experience, my fax review with the ability to send, receive. A mortgage is a form of annuity (from the perspective of the lender), and the calculation of the periodic payments is based on the time value of money formulas. Regulated lenders (such as banks) may be subject to limits or higher risk weightings for non-standard mortgages. Like a credit card balance, you can pay down a HELOC at any time, without penalties. Typically, this may lead to a higher final price for the buyers. The extra cash you receive may be less than the additional costs and fees you were charged for the refinancing. Subject to local legal requirements, the property may then be sold. Home equity loans (or lines) can fill this gap, wherein the first mortgage is frequently 80 percent of the purchase price and the Home Equity Loan is the second mortgage. The price at which the lenders borrow money therefore affects the cost of borrowing. Browse and search the latest data entry data encoder job jobs listed on freelancer com. Once the lender has the deed to your property, he starts to treat it as his own. If the loan has a prepayment penalty, you will have to pay that penalty each time you take out a new loan. A home equity loan is a type of loan in which the borrower uses the equity in their. For further details, see equity release. With this arrangement regular contributions are made to a separate investment plan designed to build up a lump sum to repay the mortgage at maturity. In many countries, credit scores are used in lieu of or to supplement these measures. Later, a message from the lender says you are being charged late fees. Jumbo mortgages and subprime lending are not supported by government guarantees and face higher interest rates. May example of letter to student loan bank xxxxxbank xxxxxxx. You agree to the project, and the contractor begins work. You've just agreed to a mortgage on terms you think you can afford. Because ownership changes twice in an Islamic mortgage, a stamp tax may be charged twice. A merchant cash advance was originally structured as a lump sum payment to a. After you get a mortgage, you receive a letter from your lender saying that your monthly payments will be higher than you expected. The loan to value ratio is considered an important indicator of the riskiness of a mortgage loan. With each refinancing, you've increased your debt and probably are paying a very high price for some extra cash. You can shop anonymously for mortgage rates for a home equity loan or line of credit on Zillow Mortgage Marketplace. To make matters worse, the work on your home isn't done right or hasn't been completed, and the contractor, who may have been paid by the lender, has little interest in completing the work to your satisfaction. Except in some cases, you should be able to avoid fees such as application or appraisal fees, though you might get hit with an annual fee or a small "recording" fee. A HELOC, or Home Equity Line of Credit, is the right to borrow up to a certain amount of money from a lender. If you are having trouble paying your mortgage and the lender has threatened to foreclose and take your home, you may feel desperate. There may be legal restrictions on certain matters, and consumer protection laws may specify or prohibit certain practices. If so, it's likely to be your greatest single asset. Commercial mortgages typically have different interest rates, risks, and contracts than personal loans. The "line" is a credit line guaranteed by your house, meaning that if you can't live up to the terms of the line, then the lender has a right (after a few nasty letters) to foreclose on your house. The process is free, easy and best of all, you are anonymous. Watch a video, How to File a Complaint, at ftc.gov/video to learn more.

Before he can help you, he asks you to deed your property to him, claiming that it's a temporary measure to prevent foreclosure. |

Seminar Series

Credit and Finance In the NewsCompare the best year cd rates certificate of deposit.

This type of mortgage is common in the UK, especially when associated with a regular investment plan. Graduated payment mortgage loan have increasing costs over time and are geared to young borrowers who expect wage increases over time. They also benefit from a gain in equity when the value of the property increases. As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a set period of time, typically 30 years. A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence home equity loan of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan. Builders may take out blanket loans which cover several properties at once. Balloon payment mortgages have only partial amortization, meaning that amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding principal balance is due at some point short of that term, and at the end of the term a balloon payment is due.

In many jurisdictions, though not all (Bali, Indonesia being one exception[2]), it is normal for home purchases to be funded by a mortgage loan.

In economics, home equity is sometimes called real property value. In the United States, the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have (as of 2004) reached about 6 per cent per annum. In one variation, the bank will buy the house outright and then act as a landlord. Some lenders may also require a potential borrower have one or more months of reserve assets available.

Home owners acquire equity in their home from two sources.

Only later, you realize that the papers you signed are a home equity loan. Offset mortgages allow deposits to be counted against the mortgage loan. A home buyer or builder can obtain financing (a loan) either to purchase or secure against the property from a financial institution, such as a bank or credit union, either directly or indirectly through intermediaries. Home Equity Loans are when a lender gives you a set amount of money and you pay it back over a fixed payment schedule. Certain details may be specific to different locations.

Smart Money Week

Flexible mortgages allow for more freedom by the borrower to skip payments or prepay.

The University ForumSome lenders and 3rd parties offer a bi-weekly mortgage payment program designed to accelerate the payoff of the loan. At closing, the lender gives you papers to sign that include charges for credit insurance or other benefits that you did not ask for and do not want. The lenders actions make it almost impossible to determine how much youve paid or how much you owe. In this way the payment amount determined at outset is calculated to ensure the loan is repaid at a specified date in the future. The lender will treat you as a tenant and your mortgage payments as rent. A biweekly mortgage has payments made every two weeks instead of monthly. Homeowners-particularly elderly, minority and those with low incomes or poor credit-should be careful when borrowing money based on their home equity. In other words, the borrower may be required to show the availability of enough assets to pay for the housing costs (including mortgage, taxes, etc.) for a period of time in the event of the job loss or other loss of income. A study issued by the UN Economic Commission for Europe compared German, US, and Danish mortgage systems.

|

|

|