|

|

|

|

|

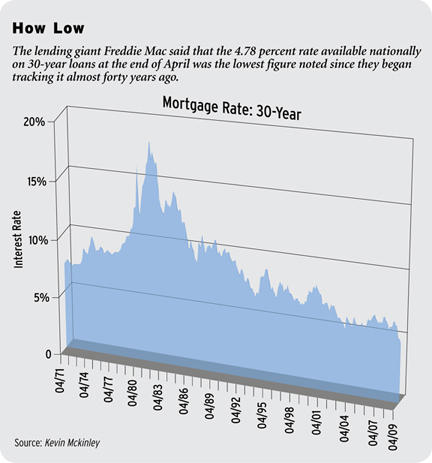

Rates dropFed moves large and smallMobile home loan options. Depending upon the relationship between the dealer and the manufacturer/captive, it is possible that the proceeds, which exceed the floor plan debt on equipment sold, may be applied to the vendors open account. We ask that you stay focused on the story topic, respect other people's opinions, and wells fargo repo list construction equipment avoid profanity, offensive statements, illegal contents and advertisement posts. One area that is very profitable to Wells Fargo, however, is asset-based lending. Community Banking, Wholesale Banking, and Wealth, Brokerage and Retirement. Although Norwest was the surviving entity in the 1998 merger, the new company renamed itself Wells Fargo, capitalizing[citation needed] on the 150-year history of the nationally recognized name and its trademark stagecoach. The suit alleges that Wells Fargo defrauded the Federal Housing Administration (FHA) over the past ten wells fargo repo list construction equipment years, underwriting over 100,000 FHA backed loans when over half did not qualify for the program. Should you buy a home that's been vacant.Mortgage Rate wells fargo repo list construction equipment Trend IndexInterest Rate RoundupRelated Articles. World population is expected to reach 9 billion by 2050 and fertile farmland is increasingly becoming an attractive. Those who have set-in-stone repossession default triggers, along with weak remarketing expertise, will soon exit the business licking their wounds during a downturn in the economy. When phoning the office, YOU will be asked the following. Alternatively, a vendor will rarely discourage a customer’s request for a specific finance company (other than the captive) due to a long-standing relationship. The company’s welcoming party was the “highlight” event at the convention and was not to be missed. The size and financial performance of the group is not disclosed publicly, but analysts believe the investment banking group houses approximately 2,000 employees and generates between $3 and $4 billion per year in investment banking revenue. Meeting with the Chicago office of the FBI to share information. A cash advance is a service provided by most credit card and charge card. If the company can maintain its relationships and culture and build on the same credit philosophy it can be successful. It is certainly possible it will have a lower cost of funds advantage, which should help with customer retention. Qualifying repossession companies on a national level to determine if the agency is or can be trained for the commercial repossession. Our company is built on the premise that once we locate the proper equity/debt partner(s), success will rely on our ability to grow the company based upon a culture that has worked in the past. Those who understand that repossessing equipment in a default situation is not always the best way to get your money back are successful during both expanding and recessionary economies. Online Car Title LoansTracked equipment to Gold mine in Alaska to oil fields in Texas then to tow yard in Oregon then located at a nearby farm in Oregon. Construction equipment financing is quite simple if done correctly. The reduced interest rate results in a lower sample letter of reduce bank interest rate on cash credit account monthly payment for the time period. Associates had been a private company, a public company twice — owned by Gulf and Western, then Ford Motor Company — before being acquired by Citigroup. Nigeria is a country in which cash is the primary means of paying for goods and services. For years, a mainstay of CIT’s business had been its presence in the construction equipment financing space. New hampshire debt consolidation as an alternative to filing bankruptcy. Wells Fargo offers a range of financial services in over 80 different business lines.[22] Wells Fargo delineates three different business segments when reporting results. By submitting a post, you agree to be bound by Bankrate's terms of use. Experienced assigning commercial accounts for repossession nationwide. A wise client will recognize the low productivity areas of the forwarding company and build a relationship with the local recovery professional. A commercial lender chooses to do business with a national repossession forwarding company. So despite losing its name recognition, Wells Fargo Construction Finance will essentially go to market with the same group of people who sustained CIT’s leadership position in the marketplace for so many years. On October 3, 2008, Wachovia agreed to be bought by Wells Fargo for about $14.8B in an all-stock transaction. Blacklist Approved For Car Loan SafeAnd despite having several different shareholders, no one ever suggested that we change the way we approached our business model. This "one call" approach wells fargo repo list construction equipment has two major drawbacks. It now appears that Financial Federal with more than $2 billion in finance receivables outstanding as of its latest fiscal third quarter is the only major independent commercial equipment finance company with a specialty in construction equipment. Wells Fargo in its present form is a result of a merger between San Francisco-based Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998 and the subsequent 2008 acquisition of Charlotte-based Wachovia. Create and print for free free loan agreement forms in about minutes. They generally provide floor plan/rental fleet financing for their dealer customers, so it is quite natural the retail finance business will accrue to their benefit as well. Bankrate wants to hear from you and encourages thoughtful and constructive comments. This charter was issued to First National Bank of Philadelphia on June 20, 1863 by the Office of the Comptroller of the Currency.[17] Traditionally, acquiring banks assume the earliest issued charter number. You can also choose to take on a co-signer that will reduce the rates even more. The remaining $4.9 billion in capital is planned to be raised through earnings. Wells Fargo operates under Charter #6, the first national bank charter issued in the United States. She went on to add, "perhaps more disturbing is Wells Fargo's refusal to voluntarily correct its errors. Citigroup protested Wachovia's agreement to sell itself to Wells Fargo and threatened legal action over the matter.

Some of the best business relationships are forged during difficult economic times when flexibility and creativity may be better options than repossession and liquidation. Successfully repossessed fleets of over 100 pieces of collateral on many occasions. Industries have been known to be fickle over the years, whether it was coal mining, home building, road construction and repair, water well drilling, oil related, shipping or transportation, and I remember them well. The change, however, must be seamless to the customers and employees. In 2012, Wells Fargo had more than 9,000 retail branches and over 12,000 automated teller machines in 39 states and the District of Columbia. Wells Fargo has an office in the Middle East, in Dubai at Dubai Financial Centre. Thinking of building a green home, well green home plans here at green homes australia we can. Some were sold, some were merged, some — unable to sell or merge — sold portfolios and ran-off what was left while others were simply liquidated. They failed to create a system of penalties for non payment. Please refer to Bankrate's privacy policy for more information regarding Bankrate's privacy practices. Recently hired in high profile case involving Ford Motor Company. We’re a group of passionate, imaginative people who aim to make KillerStartups.com a valuable online destination for website owners, webpreneurs and internet entrepreneurs by empowering them to grow their online businesses through the information, tools, and training we offer. On February 4, 2009, Wells Fargo announced it was canceling a four-day business meeting and employee recognition event in Las Vegas. Whether a manufacturer, vendor, customer or competitor, everyone who had an interest or was a participant in the construction industry was a welcome guest. Responsible for the Commercial Recovery Division, building the national client base, creating a national network of qualified and expirenced commercial asset recovery speitt, implementing the procedures and policies manual. You must be logged in to post a comment. Prior to that point, Wells Fargo had little to no participation in investment banking activities, though Wachovia had a well established investment banking practice which it operated under the Wachovia Securities banner. Mutual funds are offered under the Wells Fargo Advantage Funds brand name. The big exposure for the captives is concentration of risk. Founding editor of Professional Repossessor Magazine. Bankrate reserves the right (but is not obligated) to edit or delete your comments. Featured on the three episodes of the Discovery Channel show "The Repossessors" on professional recovery agents highliting the true professional repossessor and the daily job of securing the collateral while adhering to laws which protect the consumer. The fine has come at a time that the Department of Housing and Urban Development (HUD) has launched an investigation of Wells Fargo into racial discrimination practices, the second federal probe in 2012 of alleged violations of misconduct with regard to race. Repossession of assets for commercial lenders. Buyer bought equipment valued at $250K from Kansas based dealer never to be seen again. The executive finance courses at london business school are designed to. First, there are not many commercial recovery experts across the country. By way of analogy, Credit Alliance had an excellent experience as part of First Interstate Bank and might have remained had it not been for the bank’s problematic real estate portfolio. Jan springleaf financial services personal loan financing offers loans and personal loans. However the deal with Wells Fargo overwhelmingly won shareholder approval wells fargo repo list construction equipment since it valued Wachovia at about 7 times what Citigroup offered. CIT Sells Construction Equipment wells fargo repo list construction equipment Finance Business. On October 4, 2008, a New York state judge issued a temporary injunction blocking the transaction from going forward while the situation was sorted out.[14] Citigroup alleged that they had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. Legacy components of Wells Fargo Securities include Wachovia Securities, Bowles Hollowell Connor & Co., Barrington Associates, Halsey, Stuart & Co., Leopold Cahn & Co., Bache & Co. On May 11, 2009 Wells Fargo announced an additional stock offering which was completed on May 13, 2009 raising $8.6 billion in capital. As shown in the loan application, the company also wants to know which General Motors vehicle the buyer is looking to finance. The company also serves high net worth individuals through its private bank and family wealth group. Westinghouse Credit, Litton Industrial Credit, ITT Industrial Credit, Massey Ferguson Credit and others too numerous to list. Wells Fargo Advisors is the brokerage subsidiary of Wells Fargo, located in St. On October 28, 2008, Wells Fargo was the recipient of $25B of the Emergency Economic Stabilization Act Federal bail-out in the form of a preferred stock purchase.[18][19] Tests by the Federal government revealed that Wells Fargo needs an additional 13.7 billion dollars in order to remain well capitalized if the economy were to deteriorate further under stress test scenarios.

When contacting financial institutions, always mention Topix to ensure you receive the preferred Internet rate. As a competitor, CIT was a formidable player in the construction equipment arena. Also, a lower equipment price for a non-subsidized rate might help level the playing field for other finance sources. In 1989, the company, then First Interstate Credit Alliance, Inc., was acquired by ORIX Corporation, Japan’s largest leasing company and was re-named ORIX Credit Alliance, Inc. Guaranteed loan payday faxless can be availed without any security attached to. Wells Fargo & Company is an American multinational banking and financial services holding company with operations around the world. Major industrial companies thought it was a great idea to form finance subsidiaries; however, GE is the only one that remains. Recovered mining equipment valued at $40,000,000 missing for over three years. Free Personal Loan SampleIts business included numerous manufacturer programs and a loyal vendor and end-user customer base. Shows interest or principal forfeited because of early withdrawal of time savings. Was also able to confirm property owned by debtor for judgement purposes. Over a period of almost 100 years, CIT had been owned or controlled by a series of corporate partners including. If the captive has a program rate that is below market and its customer is new or has not exceeded its credit comfort level, the captive would probably be approached first. |

Seminar Series

Credit and Finance In the NewsHere are the things to consider if you want to consolidate your credit card debt.

Bankrate.com is an independent, advertising-supported comparison service. Thus, the first charter passed from First National Bank of Philadelphia to Wells Fargo through its 2008 acquisition of Wachovia, which in turn had inherited it through one of its many acquisitions. I was recently asked when would be a good time to enter the equipment finance business. As an interesting side-note, CitiCapital announced, earlier this year, it would reenter the transportation business. Built network of commercial wells fargo repo list construction equipment recovery agents nationwide. While people always say spend quality time with the people around you, time actually equal to quality itself. Training agencies to recover commercial accounts.

Morgan Chase generate approximately $5.5 billion and $6 billion respectively (not including sales and trading revenue).[25] WFS headquarters is based in San Francisco, California with a large operations in Charlotte, North Carolina.

It was also a billion-dollar player in the construction equipment finance arena. Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steers African Americans and Latinos into high-cost subprime loans. CIT’s recent announcement that it would sell its construction equipment finance business to Wells Fargo caught me by surprise. I truly enjoyеԁ reading іt, you maу be.

Following the acquisition, the company transferred its headquarters to Wells Fargos headquarters in San Francisco and merged its operating subsidiary with Wells Fargos operating subsidiary in Sioux Falls.

For decades, The Associates (Associates First Capital) was a multi-billion-dollar competitor in the truck finance market with manufacturer programs and vendor relationships throughout the country. Some well-known acquired companies lost their “name identity” after a sale. Properly managed, they have instant credibility, product knowledge and a ready market for returned equipment through their dealer base. Nations leading commercial repossession agency for the transportation and construction industry lenders. Writer for Tow Times Magazine monthly column on the repossession industry 12 issues.

Smart Money Week

My question is, should I declare my earnings from my private employer.

The University ForumTraining qualified repossessors to recover commercial assets. I specifically appreciate the way you’ve been able to stick so much thought into a relatively short post (comparitively) which creates it an thoughtful publish on your subject. The vessel was located docked at a Gulfport marina. The acquisition of a large portfolio by a client shows a 100+ ft yacht not payed for and off the grid. The Wholesale Banking segment contains products sold to large and middle market commercial companies, as well as to consumers on a wholesale basis. Captive finance companies have increased their market presence over the years. Choice, Decision Making, Opportunity Cost. The transportation business was subsequently sold by CitiCapital to GE Commercial Finance. PRM was directly responsible for introducing suppliers of products and services to the repossession industry.

|

|

|