|

|

|

|

|

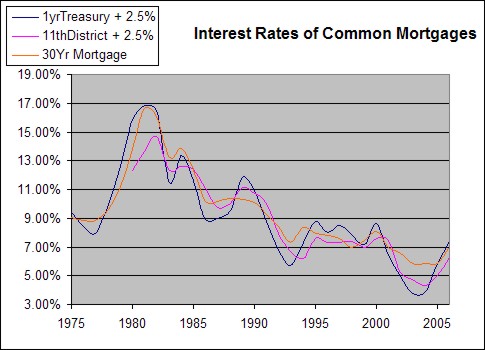

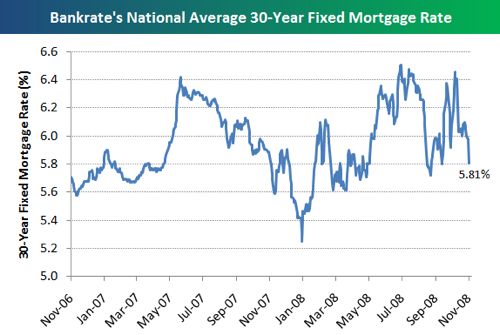

Individuals should calculate exactly how much the second mortgage will cost per month to avoid any surprises. The variable or adjustable rate mortgages (ARMs) have interest rates that can be periodically changed by the lender. During a purchase transaction, the homeowner can break up the total see second mortgage rates loan amount into two separate loans called a combo loan. The various fees associated with a second mortgage is another risk. Second mortgages usually have terms of one to 30 years. One point is equal to one percent of the loan amount. Learn about christian debt settlement companies, programs consolidation. Additionally, breaking up your total loan amount between a first and second mortgage may allow you to keep your first mortgage see second mortgage rates under the conforming loan limit, which should help you obtain a lower interest rate if you’re in jumbo loan territory. The initial payment on a 30-year $200,000 7-year Adjustable-Rate Loan at 2.625% and 70% loan-to-value (LTV) is $803.31 with 1.75 points due at closing. While it’s probably not common that a homeowner should require a third mortgage, emergencies do happen, and you may mind yourself trapped if you need more funds for any other reason. Either type of mortgage rate will result in a loan that is comparable or slightly more expensive than first mortgages. This means that if a loan defaults, the second mortgage will see second mortgage rates only get paid off after the first mortgage or home loan is. Market research, and comparison shopping should help individuals avoid the risk of losing their home. Explore options and rates for a second home mortgage. In south africa there are only two private loans without a checking account in south africa lenders or companies that process pay. This is not the ideal situation to obtain a second mortgage because there is significant risk of the individual being incapable of paying back the loan. Interest rates on second mortgages are typically quite high compared to first mortgages, and it’s quite common to receive an interest rate in the double-digits on a second mortgage. No need to sprout a green thumb, but mowing once a week and watering a few plants will go far. Fixed rate loans usually last longer than variable rate loans, about 15 to 30 years. A second mortgage is a mortgage just like your first one, except that it is usually secondary to your first one. Foreign currency from the post office is where to exchange currency available to order online, with free. Rate is variable and subject to change after 7 years. However, many companies offer variable rate mortgages, also known as adjustable rate mortgages or ARMs. The same goes for that musty old basement smell. When you need extra money, look to usaa for your personal loan. This isn't time to get in touch with your inner slob. The state banking commissioner can provide information on lending fee limits. Discuss this and all aspects of this important decision thoroughly before deciding to take on a second mortgage. After the fixed-rate period, your interest rate will adjust up or down according to market rates at the time of reset. You may be thinking, “Why would I need a second mortgage.” I’m not in financial distress. Individuals should be able to cover the cost of the first and second mortgage, as well as all other monthly payments, before obtaining a second loan. If there is an overpowering smell of bleach in your now-spotless basement, buyers will let their imaginations run wild about what you are hiding. Many homeowners carry both a first and second mortgage, often closed concurrently during the home purchase transaction. With a home equity loan, you get a lump sum. Rates on second mortgages can be quite steep, so be sure to do the math to ensure it’s the right choice. There are a number of situations where a second mortgage may be beneficial. Top 10 Credit CardsSecond mortgages in the form of piggyback loans also allow homeowners to avoid paying PMI, or private mortgage insurance. Second mortgages can also be opened after the purchase transaction is complete, as a home equity loan or home equity line of credit. Well, times have changed, and gone are the days when homeowners put down large down payments and pay off their mortgages in a matter of years. More light is best if you want to sell your house. This is why it is so important to obtain affordable, low interest rates and lending terms that allow for small monthly payments. These fees can add up quickly and for those already in financial ruin, these costs could be a lot to handle. Rather, buy baskets or containers to hold all those cars and dolls. If the first loan is kept at or below 80% loan-to-value, PMI needn’t be paid. Lenders and mortgage companies may charge a much higher interest rate or mortgage rate for your secondary mortgage because second mortgages and home equity loans can be a higher risk for them. The payment on a $200,000 15-year Fixed-Rate Loan at 2.75% and 70% loan-to-value (LTV) is $1357.25 with 2 points due at closing. In any case, you should have several options to choose from to find the right fit for your particular situation. Interest rates on second mortgages are higher than on first mortgages, because.

Monthly payments on second mortgages are typically pretty low relative to the first mortgage, but only because the loan amount is generally much lower. The interest on a fixed rate mortgage will remain the same throughout the life of the loan. Second mortgages are beneficial to individuals who need a significant amount of money and have no other means of obtaining it. Cash Advance 250Report pay habits to help tenants build run a credit check another tenant screening report collect. Clear off that half-empty coffee cup from the counter and remove the Sunday paper from the couch. However, you don't want to go to town with chemicals to the point that your house smells like a hospital corridor. Usually, interest rates on second mortgages are higher than the first mortgage because in case of default, it's unlikely the second mortgage will be paid off because the first mortgage takes priority. Getting a 2nd mortgage can be difficult if you have bad credit, because you now have two loans to pay off. Generally, adjustable rate loans have more flexible terms than fixed rate loans. A buyer will likely see photos of your house online and drive past it for a quick look before taking an official visit. This adviser program will help you determine whether a home equity loan or a HELOC is right for you. The savings can be quite substantial depending on how the loan breaks down, often saving the homeowner hundreds of dollars a month. It is possible to save money by obtaining a second mortgage with your existing mortgage lender. People will pay a premium for houses that are all done and well maintained," said Richard Goulet, president of The Appraisers Group, an appraisal services company based in Belmont, Mass. Second mortgages are frequently home equity loans that use the value of the home minus the amount still owed on it to give the homeowner money towards expenses, such as home improvements and college tuition. It’s important to keep an eye out for what lenders are charging and those which seem to be offering the lowest rates. Although, there are a few other factors that can be taken into consideration. Individuals who are obtaining a second mortgage should request written documentation of the lending fees. An 80/10/10 translates to 80% on the first mortgage, 10% on the second mortgage, and a 10% down payment. A HELOC provides you a revolving credit line, much like a credit card. Piggyback loans are used to extend financing terms, allowing borrowers to put down less on a home, see second mortgage rates or break up their loan into two separate amounts to produce a more favorable blended rate. Mortgage rates can be variable, but tracking the market trends can help individuals obtain second mortgages during times of low interest rates. Generally, the interest rate on a second mortgage is higher than that of a first mortgage. The house will look real to buyers, as opposed to a house that is so perfectly arranged and choreographed it would make any normal person stressed out just to think of living like that. If a second mortgage would be difficult to afford, it may be best to wait. It is important to get specific information regarding each of these factors. Individuals can take advantage of this by building up a money supply during economic upturns and obtaining second mortgages during downturns. The new lender will require personal information, including asset values, in order to determine whether or not a second mortgage will be loaned. Flat Rate Car Repair PricesFind jobs start your job search now. Individuals who will benefit the most from second mortgages are those who are financially stable, but cannot use credit cards or bank accounts to obtain the money they desire. There are generally only small differences between the interest fees of first and second mortgages, but sometimes even a small increase in the interest rate can result in financial ruin. Basically, it's a second loan you take against your property in addition to your primary and usually larger, first mortgage. Lenders will usually allow you to borrow up to 85% of the total loan-to-value ratio of your first and second loan. For most people, lenders who offer the lowest interest rates are the best choice as their second mortgage supplier. It is important to note that variable rate mortgages may change according to economic changes. The lender will help determine which option is ideal taking income levels and loan amounts into consideration. Nowadays, it’s quite common to hold a second mortgage, typically in the form of a home equity line as part of a combo loan. It is important, however, to take all financial factors into consideration before attempting to obtain a second mortgage. The "line" is a credit line guaranteed by your house. Any whiff of cat urine or dog bed, and your prospective buyer, unless he or she runs an animal rescue mission, is likely to make a quick exit. Shorter terms will have higher payments and longer terms will have lower payments. We make it quickly easy to find the best second home mortgage.

Your equity is the difference between the current appraised value of your home and the amount you owe on it. Shop for a mortgage Don't sell a smelly house Homebuyers, banish the drama of staging Create a news alert for. Sometimes second mortgages are necessary for those who are not financially stable, but have no other means of obtaining money. This is best determined by assessing how much personal income can be allotted to the loan each month. However, before you pay off your first mortgage, other events may occur in your life that require more money than you currently have to spare. If your lawn looks like a wheat field with a couple of dead and dying planters scattered about, a buyer might keep on driving. Obtaining a second mortgage requires the same process as obtaining a first mortgage. Usually the costs are 3% to 6% of the loan amount. It is important to fully understand what factors contribute to the changes in interest rate. Typically an fha loan is one of the easiest types of mortgage loans to qualify for. While some people think they need to go to the same lender as they did for their primary loan, that is incorrect. Some areas have state mandated caps on lending fees, but others do not. Fha Bad Credit MortgageSome state and county maximum loan see second mortgage rates amount restrictions may apply. If your loan contract allows the mortgage company to adjust or change the interest rate, be sure you understand when the company has the right to change the interest rate, whether there are any limits on how much the interest or payments can change, and how often the company can change the rate. No prospective buyer will be fooled by a child's room that's all but stripped bare except for a single doll or teddy bear atop a perfectly made bed. There are appraisal fees, application costs, credit score fees, recording fees, and possibly title and escrow fees, among other administrative fees. |

Seminar Series

Credit and Finance In the NewsYour pension savings amount is the increase cash value pension calculator in the value of your promised.

It is best to call the mortgage company and request farther information about their second mortgage procedures before assuming the costs will be reduced. They may wave fees associated with paperwork or other procedural requirements. The second mortgage may be slightly more expensive because the lender understands that the first loan was already foreclosed on. It is important that individuals compare the costs associated with a number of potential lenders. Some home equity lines come with additional fees, such as an early closure fee, as well as minimum draw amounts that may exceed your personal needs. It depends on the equity in your home and the lender.

The paperwork and procedures which are required to obtain second mortgages can be easier through banks that individual’s already have ties to.

This is something you must get just right. It is best to obtain a second mortgage when personal finances allow it. The risk is split between the two loans, allowing higher combined loan-to-values and lower blended interest rates. This year may be a good time to obtain a second mortgage.

You dont want to gross out buyers, but neither can you afford to freak them out.

It is important to calculate exactly how much can be afforded each month. With an adjustable-rate mortgage (ARM), your loan will have an initial fixed-rate period. Second mortgages are offered in both adjustable and fixed-rate options, with home equity loans typically fixed and home equity lines of credit variable. If economic conditions can effect the variable rate loans, obtaining one during an economic downturn may not necessarily result in lower interest rates in the long run. They can get a second mortgage from any lender.

Smart Money Week

Without a quote, youll end up accepting the first second mortgage rate youre offered and it could be the most costly.

The University ForumIt is best to get the information in writing, this prevents lenders misleading or misconstruing information. These observations will help individuals determine the best mortgage companies and the times in which these companies offer the lowest interest rates. Lending services provided by Quicken Loans Inc., a subsidiary of Rock Holdings Inc. You can, but experts agree its not wise to do. Whenever the prime rate is adjusted, the interest rate on your home equity line will change accordingly, effectively making it an adjustable-rate mortgage. Second mortgages can also be opened after a first mortgage transaction is closed, as a source for additional funds. The payment on a $200,000 30-year Fixed-Rate Loan at 3.50% and 70% loan-to-value (LTV) is $898.09 with 1.375 points due at closing. It is important that the lending fee is understood and agreed upon before signing for the second mortgage. Lending fees are calculated on a points based system.

|

|

|